Gross Revenue Retention Rate (GRR)

Last updated: Mar 17, 2025

What is Gross Revenue Retention Rate?

Gross Revenue Retention (GRR) Rate is the percentage of recurring revenue retained from existing customers in a defined time period, including downgrades, and cancels. It does not include any expansion revenue. GRR is also commonly referred to as Gross Renewal Rate.

Gross Revenue Retention Rate Formula

How to calculate Gross Revenue Retention Rate

Example A: A company has 100 customers, each paying $2,000 per month. MRR at the beginning of the month is $200,000. Within the month, 2 customers downgrade by $500 each, and 1 customer cancels. Applying the Gross Retention formula, we get ($200,000 - ($500 x 2) - $2,000) / $200,000 = $197,000 / $200,000 = 98.5% GRR expressed monthly

Start tracking your Gross Revenue Retention Rate data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good Gross Revenue Retention Rate benchmark?

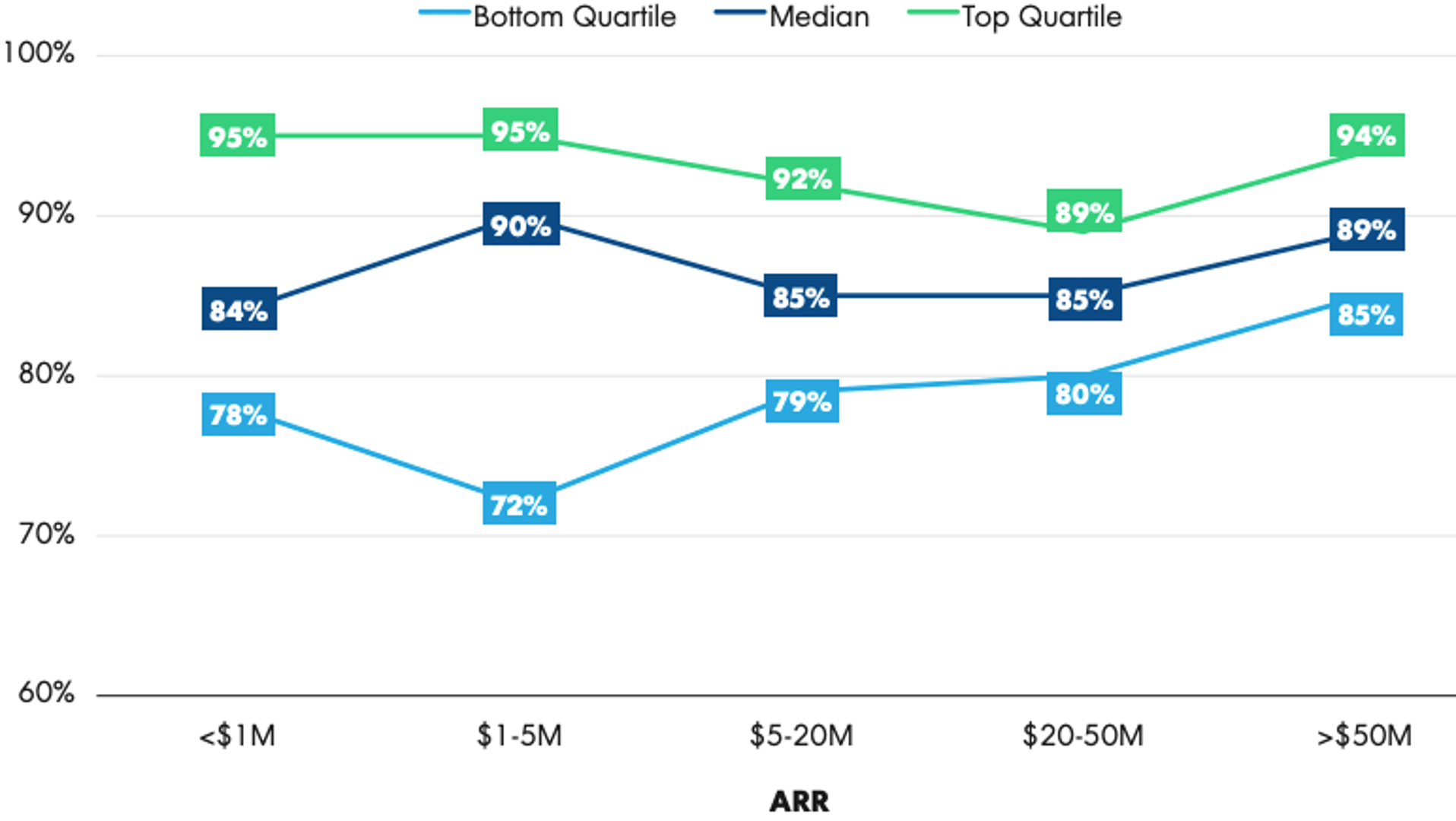

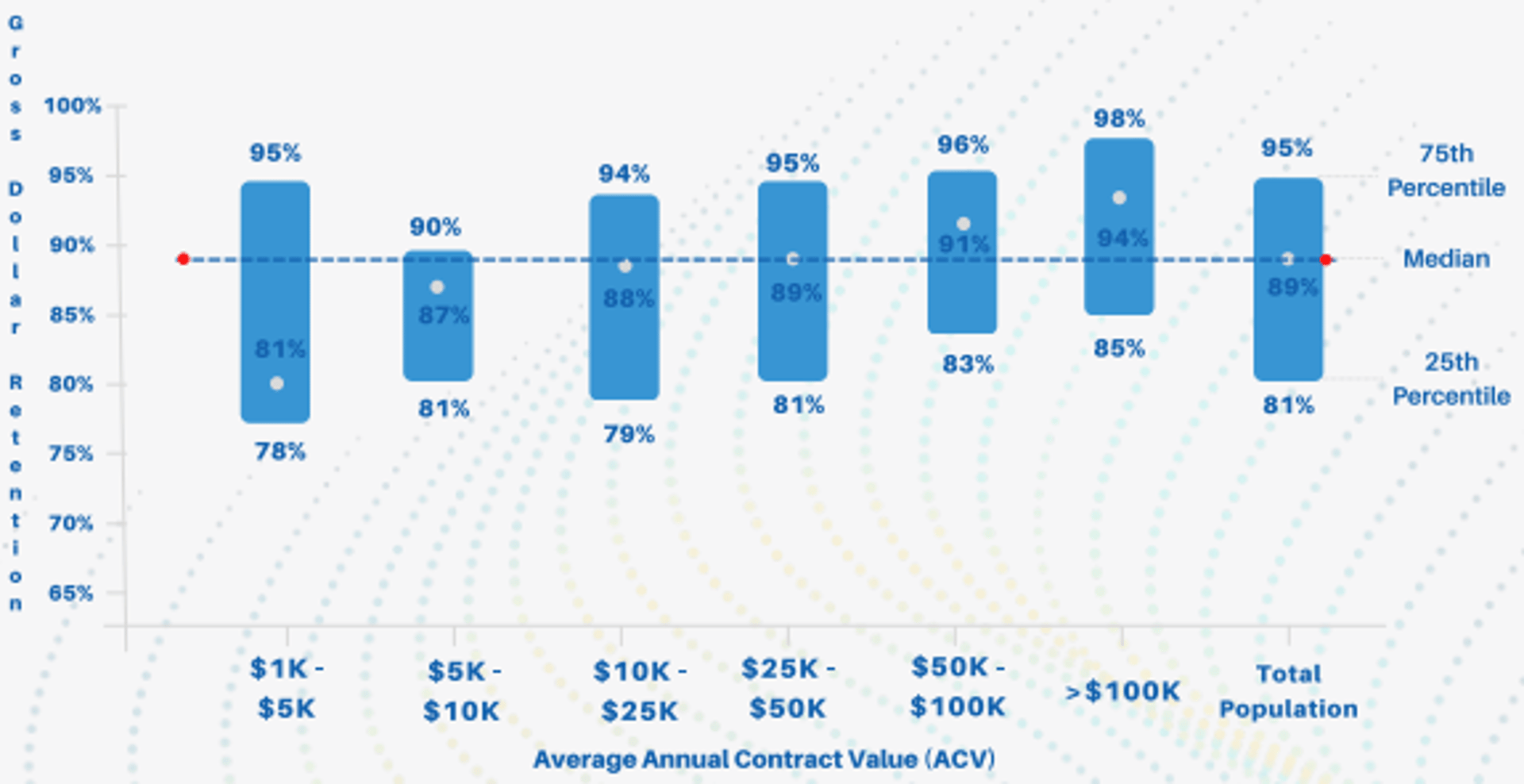

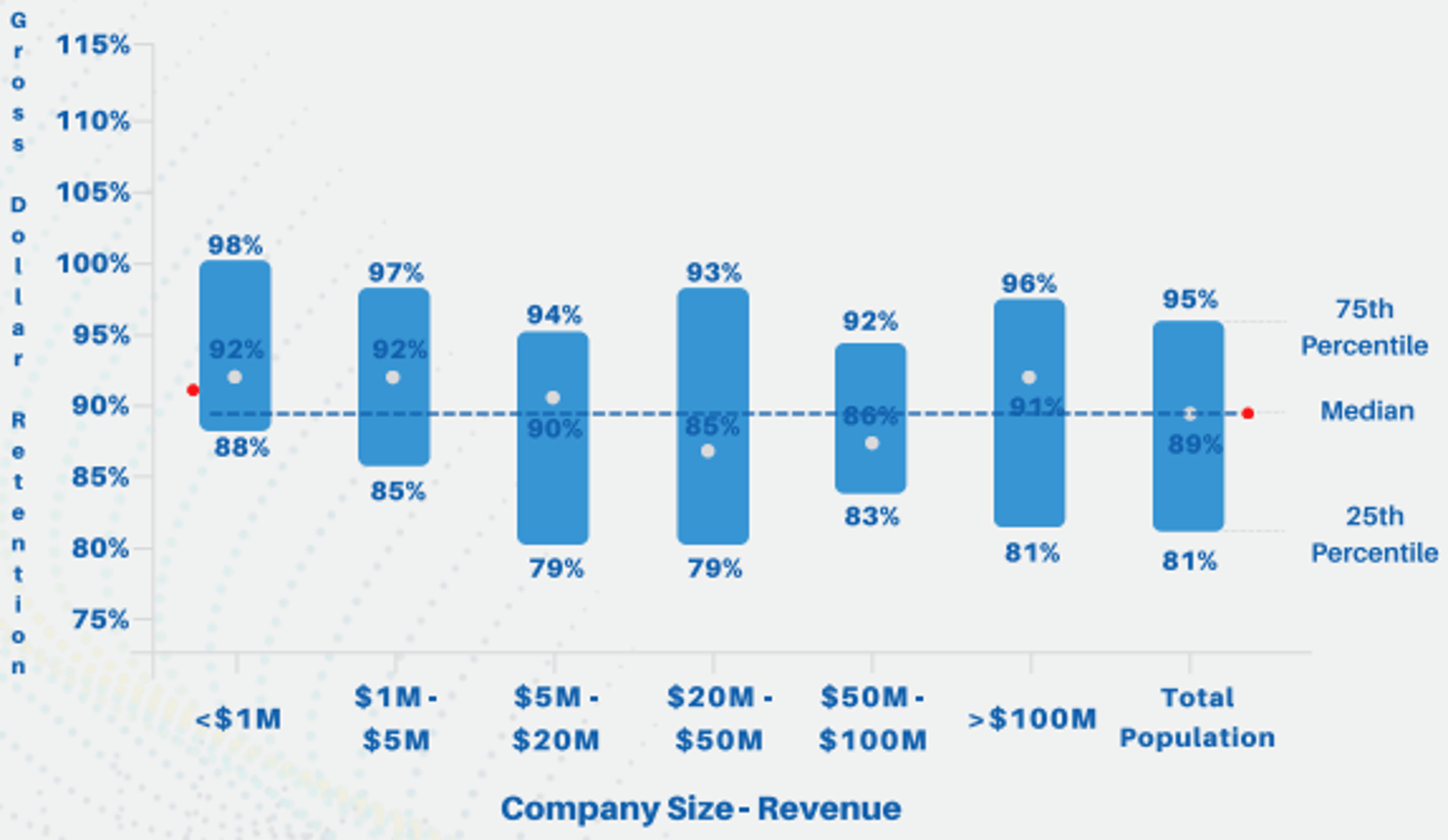

The maximum possible value for Gross Revenue Retention Rate is 100%. Across all SaaS companies, the median Gross Retention Rate is ~90%. For SaaS companies selling into small and medium businesses (SMBs), a good Gross Retention Rate is 80%. For Enterprise SaaS, 90% is considered a good Gross Retention Rate. For very high Annual Contract Value (ACV) products, Enterprise SaaS companies should benchmark themselves to 95%. Further qualifying this, when looking at its own portfolio of companies scaling to $10M in ARR, Bessemer Venture Partners, reports the bottom quartile at less than 85%, the middle at 90%, and the top quartile at 95% GRR. April 2022.

Gross Revenue Retention Rate benchmarks

Annual Gross Dollar Retention by ARR

Gross Revenue Retention by ACV

Gross Revenue Retention by Revenue

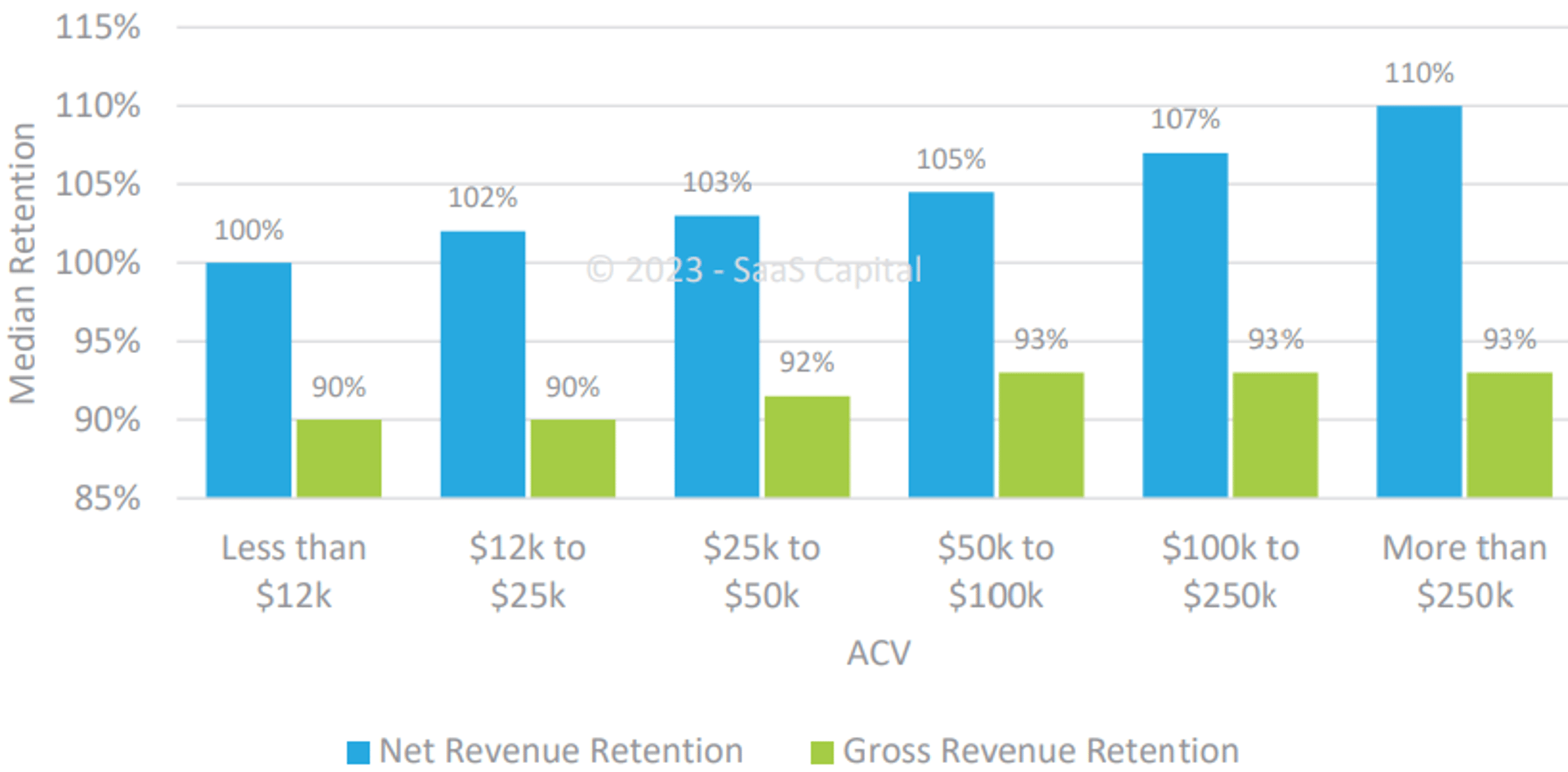

NDR and GRR by ACV

How to visualize Gross Revenue Retention Rate?

Since Gross Retention is usually tracked as a percentage, yearly or monthly, it's best to visualize your GRR as a line chart. This way, you have a wealth of historical data and can detect early signs of churn. Take a look at the sample chart for an idea of what it looks like when you track GRR over time:

Gross Revenue Retention Rate visualization example

Gross Revenue Retention Rate

Line Chart

Gross Revenue Retention Rate

Chart

Measuring Gross Revenue Retention RateMore about Gross Revenue Retention Rate

Retaining customers is key for operating a healthy and profitable business. A high Gross Retention Rate is an indication that your offering represents a strong value proposition for your customers. This is sometimes referred to as having a “sticky” product.

Maximizing your Gross Retention is also an important component of profitability. Acquiring a new customer can be 5 - 25 times more costly than retaining an existing customer. By retaining your existing customers, you reduce your Customer Acquisition Cost (CAC), therefore increasing your profitability.

While you want your Gross Retention to be as high as possible, the maximum is 100%, and even that is virtually unattainable after a few years in business. Some churn is simply unavoidable, but this can be a smaller percentage that you might think. Companies should analyze the reasons behind all churn, and segment into what is truly avoidable versus what could be avoided if concrete actions were taken in the future. Then take steps to implement those actions. For example, mature and proactive Customer Success practices have been proven to increase Gross Revenue Retention.

For a comprehensive understanding of retention, it’s important to track both the percentage of all customers who renew or cancel contracts, measured by logo churn, and the percentage of all revenue dollars under contract which renew.

Gross Revenue Retention Rate Frequently Asked Questions

What's the difference between Net Revenue Retention and Gross Revenue Retention?

Net Revenue Retention factors expansion into the calculation whereas Gross Revenue Retention (GRR) does not measure expansion(in the form of upgrades). Use GRR to measure revenue stability and NRR for the bigger picture of growth and revenue flow. Read in detail on the NRR vs GRR Comparison Page.

Recommended resources related to Gross Revenue Retention Rate

Lincoln Murphy debunks the myth of unavoidable churn.Contributor

.jpg)

Podcast Episode