ARR Multiple

Last updated: Mar 28, 2024

What is ARR Multiple?

The ARR Multiple in SaaS calculates the ratio between a company’s valuation and its Annual Recurring Revenue (ARR). This metric can be used to estimate the approximate value of a private SaaS company.

ARR Multiple Formula

How to calculate ARR Multiple

To calculate an ARR Multiple, divide the company's valuation by the Annual Recurring Revenue for that period. For example, say a company that is worth $100M and earns an ARR of $10M. During the time of valuation, this company would have an ARR multiple of 10X.

Start tracking your ARR Multiple data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good ARR Multiple benchmark?

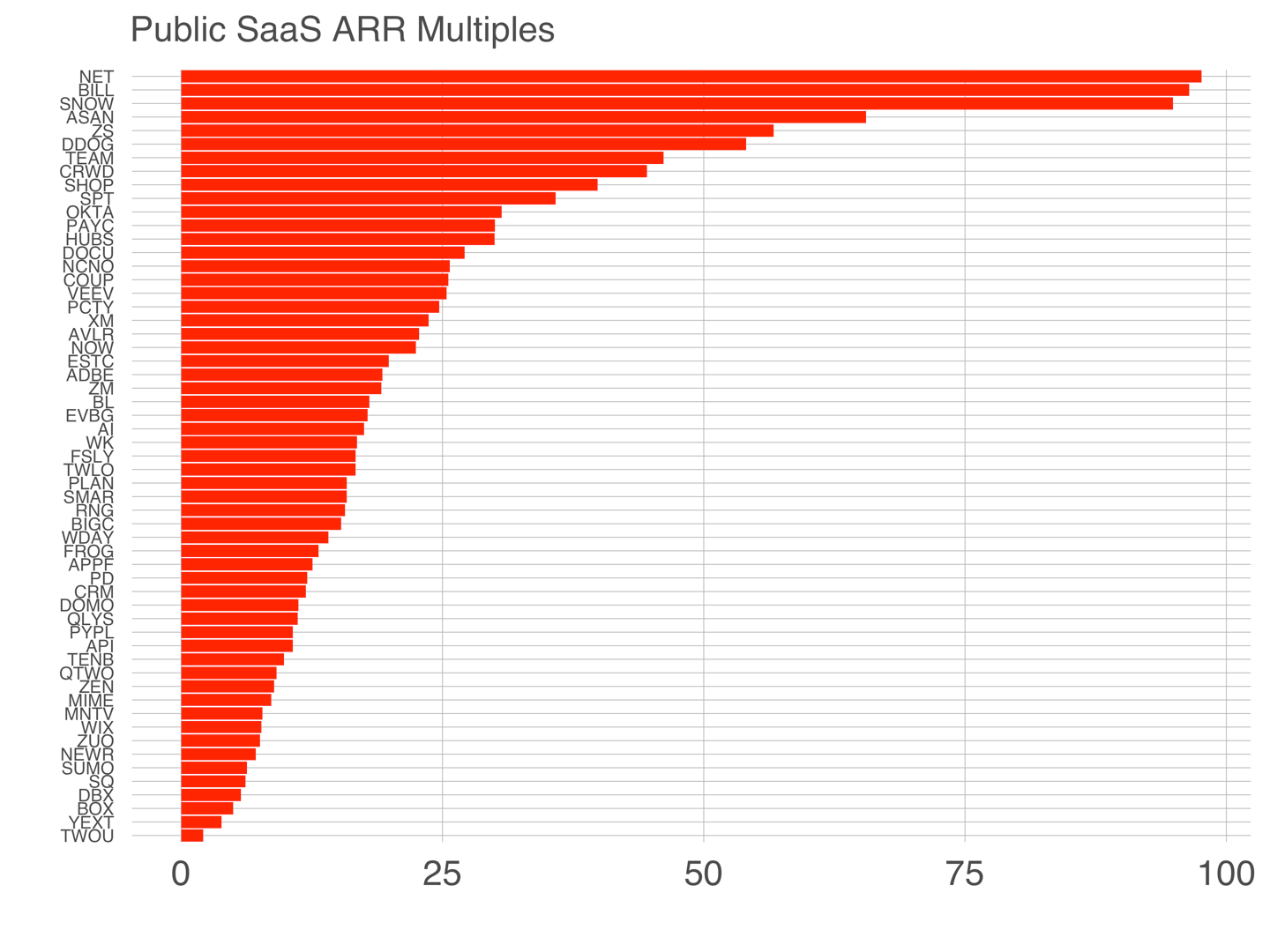

The median ARR Multiple for public SaaS companies is 17X, with the 75th percentile hovering around 26X. In general, SaaS companies tend to have an ARR multiple between 4X and 9X.

ARR Multiple benchmarks

Public SaaS ARR Multiple by Quartile

How to visualize ARR Multiple?

SaaS valuation multiples are usually expressed as a single number. Therefore, it is best to visualize your ARR Multiple in a summary chart. This displays your data in a "metric" view where you can compare your current value to a previous period.

ARR Multiple visualization example

Summary Chart

ARR Multiple

Chart

Measuring ARR MultipleMore about ARR Multiple

ARR Multiple, which divides a company’s worth by its annual recurring revenue, is mainly used to determine how a company’s ARR stacks against its valuation. Investors value companies based on multiple factors including revenue and growth. By calculating the ARR Multiple, you get a good picture of how a company has been valued based on ARR. In general, public cloud companies range between 4X and 9X.

The main reason to track a company's ARR Multiple is to understand how much a potential investor would be willing to pay or invest in the company, relative to the recurring revenue currently generated. To see how this metric grows after raising capital, track Growth in ARR Multiple since last raise.

ARR Multiple Frequently Asked Questions

What does ARR mean?

ARR refers to Annual Recurring Revenue. Read the detailed ARR definition on MetricHQ.

Contributor