Logo Churn

Last updated: Dec 01, 2025

What is Logo Churn?

Logo Churn (also called Customer Churn or Account Churn) measures the number or percentage of customers who cancel their subscription or stop doing business with a company during a specific time period, regardless of the revenue value of those customers. Unlike revenue-based churn metrics, Logo Churn treats all customer losses equally, making it a critical indicator of product-market fit, customer satisfaction, and business model sustainability.

Logo Churn Formula

Start tracking your Logo Churn data

Build and track this metric in PowerMetrics, a modern analytics platform that lets you define metrics and connect your own data.

Get PowerMetrics FreeWhat is a good Logo Churn benchmark?

Logo churn benchmarks vary dramatically by customer segment and business model: SMB/Small Business SaaS: Excellent: <3% monthly (<30% annual) Good: 3-5% monthly (30-45% annual) Acceptable: 5-7% monthly (45-58% annual) Poor: >7% monthly (>58% annual) Mid-Market SaaS: Excellent: <2% monthly (<22% annual) Good: 2-3% monthly (22-30% annual) Acceptable: 3-5% monthly (30-45% annual) Poor: >5% monthly (>45% annual) Enterprise SaaS: Excellent: <1% monthly (<11% annual) or <5% annual for annual contracts Good: 1-2% monthly (11-22% annual) or 5-10% annual Acceptable: 2-3% monthly (22-30% annual) or 10-15% annual Poor: >3% monthly (>30% annual) or >15% annual By Contract Type: Monthly contracts: 3-7% monthly churn is common for SMB Annual contracts: 10-25% annual churn is typical across segments Multi-year contracts: <10% annual churn expected for enterprise Consumer/B2C Subscription: Excellent: <5% monthly Acceptable: 5-10% monthly High-churn categories (streaming, gaming): 10-15% monthly can be normal Context matters: A 5% monthly logo churn rate is concerning for enterprise SaaS but might be acceptable for SMB-focused products with $50-200/month price points where some churn is inevitable due to business failures and budget constraints. Rule of thumb: For sustainable SaaS growth, aim for annual logo churn <20% (or <2% monthly). Above this threshold, you're replacing >20% of your customer base annually, which strains acquisition resources and signals product-market fit issues.

Logo Churn benchmarks

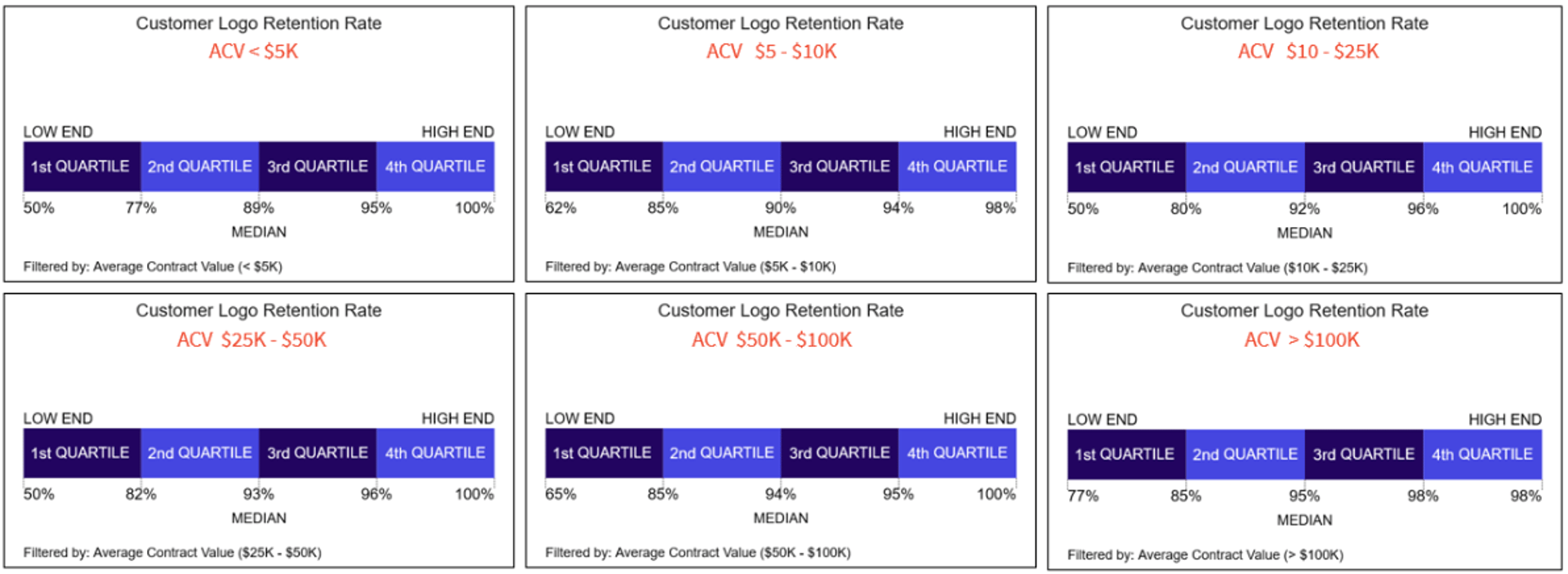

Annual Logo Retention by ACV

How to visualize Logo Churn?

Use a summary chart to visualize your Logo Churn data and compare it to a previous time period.

Logo Churn visualization example

Summary Chart

Logo Churn

Chart

Measuring Logo ChurnMore about Logo Churn

Logo Churn is the rate at which a company loses customers (unique accounts or "logos") over a defined period. This metric counts customer departures as discrete events—whether a $100/month customer or a $10,000/month customer churns, each counts as one lost logo. Logo Churn is particularly revealing for understanding whether your product delivers consistent value across your customer base, as high logo churn indicates widespread dissatisfaction or poor fit even if revenue metrics appear healthy due to a few large accounts.

For subscription businesses, logo churn is often considered the most fundamental health metric because customer acquisition is expensive and time-consuming, making retention the primary driver of sustainable growth and profitability.

Why Logo Churn Matters:

- Product-market fit indicator: High logo churn (>5% monthly for SMB, >2% monthly for mid-market) signals that customers aren't finding lasting value, regardless of revenue performance. This is an early warning sign that precedes revenue problems.

- Cost dynamics: Customer Acquisition Cost (CAC) is typically 5-25x higher than retention costs. Every churned customer requires acquiring 1+ new customers just to maintain status quo, creating a "leaky bucket" that undermines growth efficiency.

- Lifetime Value foundation: Logo churn is the denominator in LTV calculations. A company with 3% monthly logo churn has average customer lifetime of 33 months, while 5% monthly churn yields only 20 months—a 40% reduction in LTV that cascades through unit economics.

- Growth requirement: Net customer growth = New Customers - Churned Customers. A company with 5% monthly logo churn must acquire >5% new customers monthly just to maintain flat customer count. At scale, high churn makes growth mathematically unsustainable.

- Segmentation insights: Logo churn analyzed by customer segment (size, industry, acquisition channel, plan tier) reveals which customers fit your product best and where to focus acquisition and retention efforts.

Logo Churn vs. Revenue Churn:

These metrics tell different stories and both are essential:

Logo Churn (customer count-based):

- Measures product-market fit and broad customer satisfaction

- Treats $100 customer same as $10,000 customer

- More sensitive to SMB/small customer problems

- Best for understanding whether product serves the masses

MRR/ARR Churn (revenue-based):

- Measures financial impact of customer loss

- Weighted by customer value

- More sensitive to enterprise/large customer problems

- Best for understanding P&L impact

Critical insight: You can have seemingly acceptable revenue churn (2% monthly MRR churn) but terrible logo churn (8% monthly) if you're losing many small customers while retaining a few large ones. This indicates:

- Poor product-market fit in your core segment

- Over-dependence on a few large accounts (concentration risk)

- Unsustainable growth model (large customers eventually churn too)

Conversely, high logo churn with low revenue churn might indicate:

- Strong enterprise product-market fit, weak SMB fit

- Potential to "graduate" from SMB to enterprise focus

- Need to raise minimum contract sizes or improve SMB onboarding

Important Considerations:

Defining "churned":

- Voluntary churn: Customer actively cancels or chooses not to renew

- Involuntary churn: Account canceled due to payment failure, delinquency, or policy violation

- Track both separately—involuntary churn is often recoverable through payment retry logic or dunning campaigns

Time period selection:

- Monthly: Standard for monthly or annual subscriptions, provides fastest signal

- Quarterly: Useful for annual contracts to smooth volatility

- Annual: Best for multi-year contracts or when measuring mature business health

Cohort analysis:

- Calculate logo churn by acquisition cohort (e.g., customers acquired in Q1 2024) to understand if retention is improving over time

- Newer cohorts should show better retention as you optimize onboarding and product

Seasonal considerations:

- Some businesses have seasonal churn patterns (e.g., fitness apps peak churn in February, tax software churns post-tax season)

- Compare year-over-year, not month-over-month, to account for seasonality

Logo Churn Frequently Asked Questions

We have 3% monthly logo churn but only 1% MRR churn due to strong expansion revenue. Is this acceptable or a red flag?

This is a yellow flag that warrants investigation, not celebration. While positive net revenue retention is good, the gap between logo churn (3% monthly = ~30% annual) and MRR churn (1% monthly = ~11% annual) reveals potential structural issues. You're losing roughly one-third of customers annually but masking it with expansion from surviving customers, which creates three risks: First, dependency vulnerability—you're relying on a shrinking base of customers to expand enough to offset losses, and eventually you run out of expansion headroom or lose a few large expanders. Second, product-market fit concerns—high logo churn indicates your product doesn't work for a significant portion of customers, suggesting you're acquiring wrong-fit customers or failing at onboarding/adoption. Third, growth inefficiency—you're constantly backfilling lost customers instead of compounding growth, meaning CAC is partially wasted on customers who don't stick. The right response is segment analysis: calculate logo churn and revenue churn by customer size, acquisition channel, and use case. You may discover that small customers churn at 8-10% monthly (very high) while enterprise customers churn at <1% (excellent), indicating you should either fix your SMB product-market fit or pivot upmarket entirely. Acceptable outcomes include deliberately moving upmarket and exiting small customers, or investing heavily in SMB onboarding to reduce their churn to <5% monthly. What's not acceptable is ignoring the signal and assuming expansion will always compensate—sustainable SaaS businesses need both low logo churn AND healthy expansion, not one masking the other.

How should we handle involuntary churn (payment failures) differently from voluntary churn in our logo churn calculations and strategy?

Track them separately because they have completely different root causes and remediation strategies, and conflating them obscures both problems. Involuntary churn (failed payments, expired cards, insufficient funds) typically represents 20-40% of total SMB churn but is often 70-90% recoverable through proper dunning processes, payment retry logic, and account updater services. This is "lazy revenue" left on the table—customers who want to stay but have payment friction. Your strategy here is operational: implement smart retry logic (retry failed payments 3-7 times over 2-3 weeks with varying timing), send proactive email campaigns ("Your card is expiring soon—update now"), use payment services that auto-update expired cards, and have customer success reach out to high-value accounts with payment issues before cancellation. Voluntary churn (active cancellations, non-renewals) is 80-100% driven by value perception—customers consciously decided your product isn't worth the cost. This requires product and customer success interventions: improve onboarding to drive faster time-to-value, build features customers actually need, optimize pricing and packaging, conduct exit surveys to understand "why" and address systemic issues, and implement proactive health scoring to catch at-risk customers before they decide to leave. Report both metrics in your executive dashboards: "Total Logo Churn: 4.5% (Voluntary: 3.0%, Involuntary: 1.5%)" so you can set appropriate targets for each. A company with 2% voluntary churn and 3% involuntary churn has very different problems than one with 4% voluntary and 1% involuntary—the former needs better payment infrastructure, the latter needs better product-market fit. Best-in-class SMB SaaS companies achieve <0.5% involuntary churn through excellent payment operations, making voluntary churn the only meaningful battle.

Our annual logo churn is 25%, but our sales team says that's normal for our SMB customer base. Should we accept this or invest in reducing it?

Don't accept it—25% annual logo churn means you're replacing one-quarter of your customer base every year, which is a massive drag on growth and indicates either wrong target market or execution problems, even for SMB. While SMB inherently churns higher than enterprise (due to business failures, tighter budgets, less switching cost), best-in-class SMB SaaS achieves 15-20% annual logo churn, with exceptional companies reaching <15%. The "it's normal for SMB" excuse often masks avoidable problems: poor onboarding (customers never reach activation), weak product-market fit (you're selling to anyone with a credit card rather than ideal customers), pricing misalignment (price exceeds perceived value), or neglected customer success (no proactive engagement post-sale). Calculate the economic impact: if your LTV is $5,000 at 25% churn but would be $7,500 at 15% churn, every percentage point of churn improvement yields 50% more LTV and dramatically improves unit economics—making customer acquisition far more profitable. Invest in retention by: conducting exit interviews to understand why customers leave and address top three reasons systematically; implementing onboarding sequences that drive customers to activation milestones within 30 days; using engagement scoring to identify at-risk customers before they churn and intervening proactively; and potentially tightening ideal customer profile (ICP) to stop acquiring customers who are unlikely to succeed, even if it slows topline growth temporarily. The counterargument—"we should focus on acquisition, not retention"—only works if you have unlimited CAC budget and don't care about profitability, which describes almost no sustainable business. Even a moderate investment that reduces churn from 25% to 20% increases customer lifetime from 4 years to 5 years (+25% LTV) and dramatically improves the growth compounding effect, as you're no longer dedicating 25% of new customer acquisition just to replace losses.

Recommended resources related to Logo Churn

A great article by Lincoln Murphy on Churn and what's acceptableContributor

.png)