Burn Multiple

Date created: Oct 12, 2022 • Last updated: Mar 21, 2024

What is Burn Multiple?

Burn Multiple measures how much a startup is burning in order to generate each incremental dollar of ARR. This metric evaluates burn as a multiple of revenue growth. The higher the Burn Multiple, the more the startup is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is.

Burn Multiple Formula

How to calculate Burn Multiple

Q1 just ended and it’s time for a board meeting. The startup reports that it burned $2M in the quarter while adding $1M to its ARR. That’s a 2x Burn Multiple — reasonable for an early-stage startup. On the other hand, if the company burned $5M in Q1 to add $1M of net new ARR, that’s a terrible Burn Multiple (5x). It should probably cut costs immediately. That company is spending like a later-stage company without delivering later-stage growth.

Start tracking your Burn Multiple data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeWhat is a good Burn Multiple benchmark?

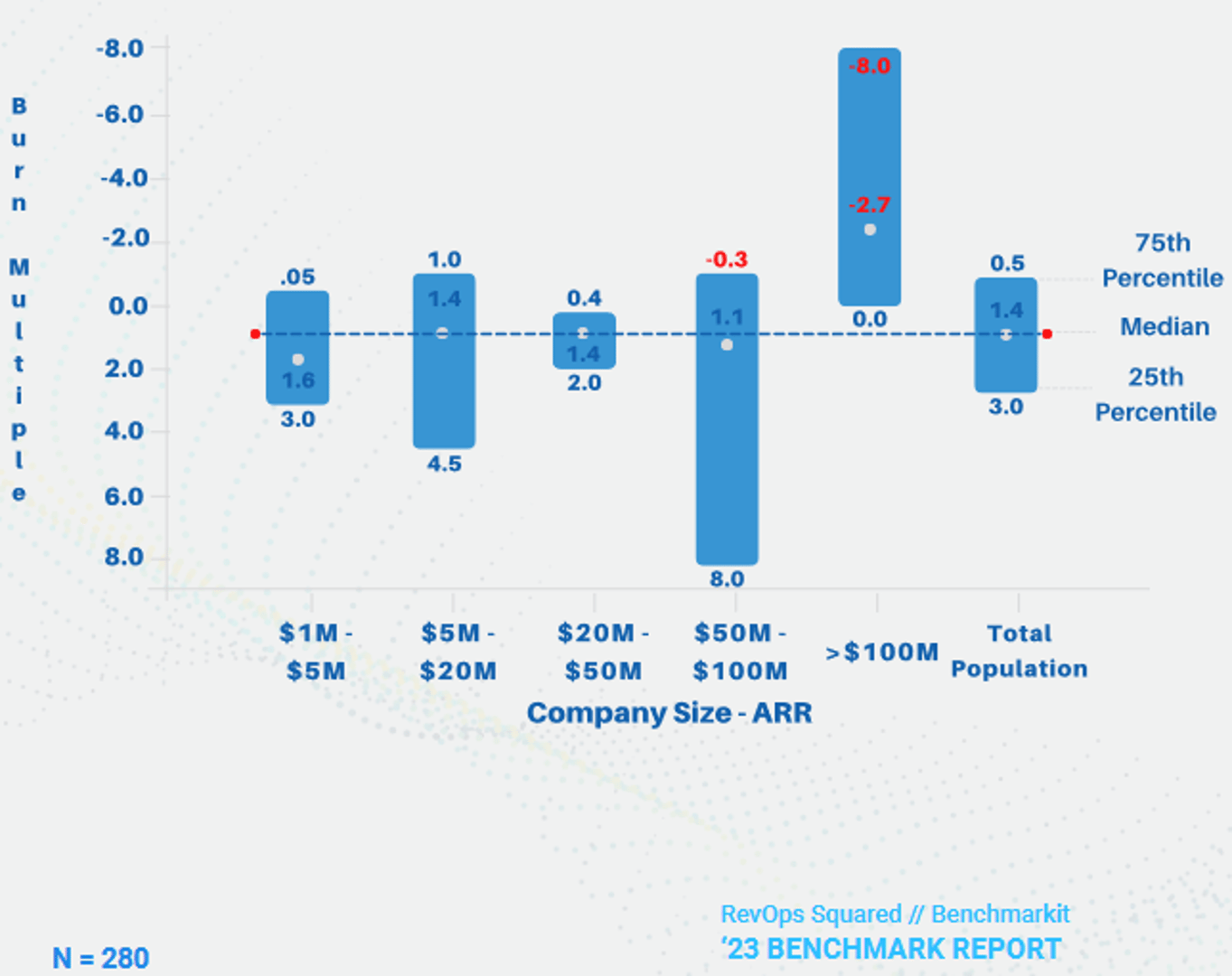

For SaaS companies at 1-3M in ARR, the median Burn Multiple is between 1.7x. At 3-5M in ARR, the multiple drops to 1.0x, at 5-10M in ARR it hits 0.65x, and then reaches 0.85x for companies at 10-15M in ARR. Capchase 2022, n=439.

Burn Multiple benchmarks

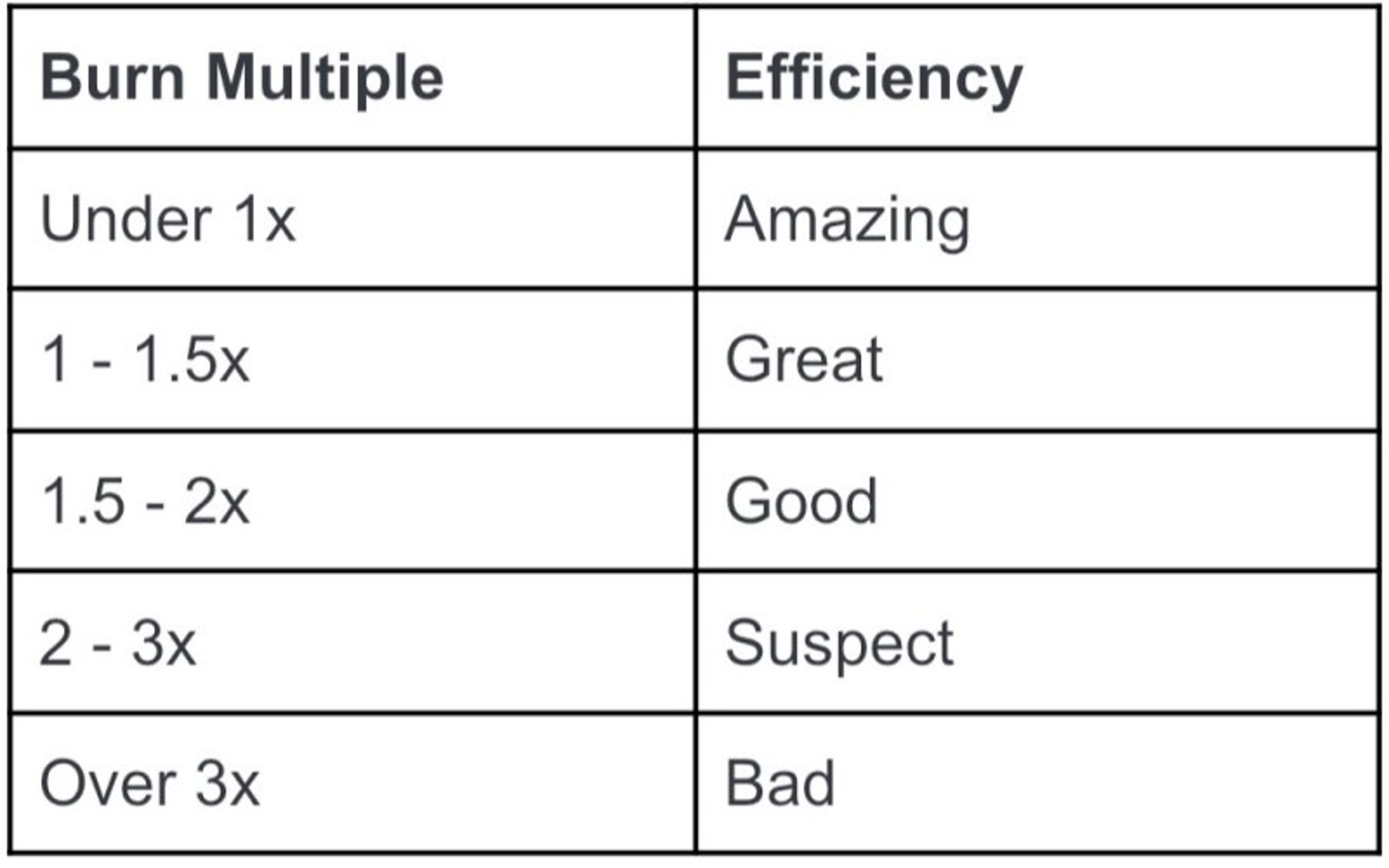

Burn Multiple Efficiency Rating

Monthly Burn Rate by Revenue

How to visualize Burn Multiple?

A summary chart is the best way to visualize Burn Multiple. Summary Charts display the current value in comparison with the past. Take a look at the example:

Burn Multiple visualization example

Summary Chart

Burn Multiple

Chart

Measuring Burn MultipleMore about Burn Multiple

Venture Capitals use the Burn Multiple to help assess the quality of product-market fit. The startup that generates $1M million in ARR by burning $2M is more impressive than one that does it by burning $5M. In the former case, it appears that the market is pulling product out of the startup, whereas in the latter case, the startup is pushing its product onto the market.

The beauty of the Burn Multiple is that it’s a catch-all metric. Any serious problem will eventually impact the Burn Multiple by either increasing burn, decreasing net new ARR, or increasing both but at disproportionate rates.

If the startup is pre-revenue, net new ARR will be zero so the ratio will not even compute. The founders should focus on keeping burn low and crossing the Penny Gap, in other words getting their first few paying customers, as quickly as possible. The Burn Multiple should improve as the startup matures. Eventually, for a company to become profitable, burn must reach 0, which implies that the Burn Multiple should also approach 0 over time.

Recommended resources related to Burn Multiple

Read about Burn Multiple from David Sacks.Metric Toolkit

Start tracking your Burn Multiple data

Use Klipfolio PowerMetrics, our free analytics tool, to monitor your data.

Get PowerMetrics FreeContributor